No Money, No Honey: Navigating Berlin’s FinTech Funding Opportunities

Berlin’s Fintech Flywheel: Navigating the Funding Jungle

FinTech is an exceptionally capital-intensive industry due to the significant resources required for technological development, regulatory compliance onwards from day one, and scaling operations in highly competitive markets.

In the first half of 2024, 51 fintech funding deals were closed in Germany, totaling approximately 482.1 million US dollars, according to KPMG's latest "Pulse of Fintech H1/24" report. This marks a 19% increase in investment volume compared to the second half of 2023. In contrast, Germany outperformed the broader European market, where fintech funding experienced sharp declines, with a 50% drop in France and a 29% decrease in the UK.

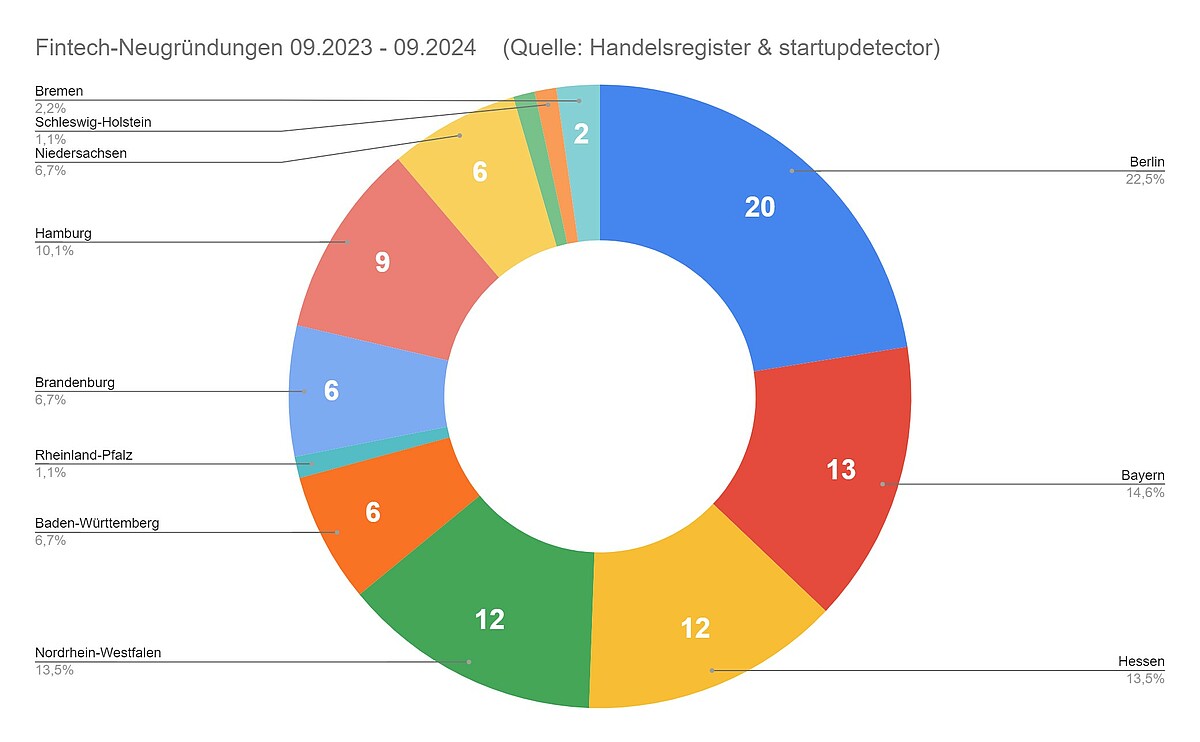

Within Germany, Berlin remains the central hub for FinTech investment, where startups and investors have generated a flywheel effect, consistently attracting both founders and new capital. Of the 89 startups incorporated across Germany in the past 12 months, 20 are based in Berlin. This exclusive data analysis was conducted by Startupdetector for Reason-Why.Berlin.

This article aims to guide FinTech startup founders through the complex funding landscape in Berlin, diving deep into detail. It will also explore why Berlin stands out as a prime location for early-stage FinTech funding.

From Pre-Seed to IPO: Understanding the Lifecycle of a FinTech Startup

Startups typically pass through several stages, each with its own characteristics, milestones, and funding needs. From the initial idea to a potential IPO, the path is shaped by constant evolution, strategy shifts, and varying capital requirements. Here's a breakdown of the key stages:

The Pre-Seed stage is where founders develop their initial idea into a concept or prototype, focusing on validating the business idea. Funding typically comes from personal savings, family, friends, or angel investors. The main goal is to confirm feasibility and build an initial team.

Next, the Seed Stage sees the creation of a working prototype, with initial market tests and the development of a market strategy. Seed investors often come on board, aiming to build a user base and create a marketable product.

In the Early Stage (Series A/B), the product is market-ready, and the business focuses on scaling. Venture capital firms fund this phase, aiming for market expansion and revenue growth.

The Growth Stage (Series C+) involves rapid expansion, often through new product launches or acquisitions. Large capital injections from investors prepare the company for an exit, usually through an IPO or acquisition.

In the Late Stage/Pre-IPO, the company is an established player, preparing for an IPO or strategic sale.

The IPO/Exit phase concludes the startup’s journey, raising public capital or selling to a larger company.

Please note, this is an idealized version – in reality, the journey of a FinTech startup rarely follows a smooth or linear path. Every company has its own unique, often unpredictable course, shaped by the challenges and opportunities it encounters along the way. It rather may look like this:

Breaking Into Berlin’s FinTech Scene: Insights from the Experts

Berlin's funding landscape is a jungle, and navigating it from the outside can seem nearly impossible. The relevant factors vary not only from one funding stage to another, but also from one FinTech startup to the next. It’s not just a job, but a truly challenging one. Unfortunately, this article can’t do the job for you, but it can provide an overview and offer some guidance on where to begin.

So, what do you do when you enter uncharted territory? You start by gathering as much information as possible. There are countless resources to explore, though their accuracy and timeliness can vary. Platforms like Crunchbase, F6S, and Dealroom are great starting points for Berlin-based startups. Dealroom, in particular, offers a dedicated vertical for the city through the Startup Map Berlin, making it a useful tool for filtering through the data and gaining insight into the local ecosystem.

And when you have done your desk research - you test the waters. “I’d say go ahead and test both the market with potential customers and the interest from investors, even before formally incorporating.” says Arnas Bräutigam, who has not only started startupdetector - which provided the infographic further above - but also AddedVal.io. “AddedVal.io is a platform that connects early-stage startups in the pre-seed or seed phase with business angels.” pitches Arnas. His startup provides access to over 1,000 registered angel investors that can be contacted directly. Additionally, through its sister service Startupdetector, it has spent the past five years analyzing commercial registries in Germany, resulting in a database of more than 7,000 angel investors.

David Rhotert is also connecting you with angel investors with Companisto, which he co founded. “As a founder, you constantly need capital. Of course, there are VCs, but especially in the early stages, you really need business angels – wealthy private individuals.” he says. Companisto has created a large infrastructure, essentially a big stage for founders to showcase their startups. If selected, founders have the opportunity to present their ideas, and if they manage to convince the audience – similar to a festival – they don’t just attract supporters, but also investors, explains David. Additionally, Companisto’s leadership team recognized that the entire equity investment process could be streamlined through digitalization and improved procedures, which has enabled them to facilitate over 250 million euros in startup investments over the past decade.

At some point, you may need to get your boots on the ground in Berlin and dive right in. Berlin’s FinTech scene is known for being open and having a supportive community where members help each other. Take advantage of this – get there, start talking to people, including startup founders and investors. You’re likely to receive a wealth of feedback and can easily benefit from the experiences and insights of those already active in the field.

Insights, like this personal learning from David: “I think one of the key aspects is how to present yourself to investors, and from the very beginning, we made it our goal to support teams in this process. This isn’t just an anonymous platform where you upload your information and hope for the best. First, you need to convince us, and then we actively help teams fine-tune their pitch. This includes the pitch deck, a few documents, and a video. Every founder thinks they can do this, but after more than ten years of experience, I can tell you that very few truly put themselves in the shoes of external investors and build a pitch that’s clear and persuasive. It’s crucial to first ensure that the audience understands what the startup is about and then dive deeper in a convincing way.”

FinTech Founder Sophie Thurner also shares her learnings: “I’d say you always learn a lot when you're fundraising. We've only gone through one round so far, but people always say, ‘Next time, I'll definitely do things differently.’” Sophie co-founded beatvest, where she and her team developed an app focused on financial education and investing, designed to teach users how to invest in the stock market using simple language, in a style similar to Duolingo. Her top three fundraising lessons are:

“First, it really helps to have all your documents ready before you start fundraising, ideally in a data room, so you’re not scrambling to find things and can send everything to investors easily.

The second is to plan the process very structurally. Have a clear strategy in place. Who are the business angels or VCs you really want on board? Maybe practice your pitch with others first to test your storyline. Having a solid plan – knowing when to approach whom – makes a big difference.

And lastly, I've heard from so many founders that something went wrong right at the end, even when the round was already committed. VCs dropped out or didn’t show up for the notary appointment. So, I’d say always have a Plan B and never stop conversations. Even if you have a signed term sheet and the notary appointment is set, keep going, because you never know what might happen.”

David from Companisto recommends a similar strategy: “As a founder, I would always plan with multiple options in mind. It’s a way of managing risk by bundling several financing options, rather than playing them against each other. For example, you might combine an individual angel, a strategic investor, a VC, and a large network like Companisto’s. By pursuing these options in parallel, even if one falls through, you still have a solid path to securing the necessary funding.”

With 10 years of match-making experience, David emphasizes the importance of a long-term approach to fundraising: "Investor relations are often underestimated. Many founders treat reporting as something they do just because it’s required – I’ve been guilty of that myself. But reporting is actually a recurring opportunity to secure follow-up investments, introduce new ideas, strengthen connections with investors, and generate network effects. So, it's definitely worth putting more effort into it."

The German language can be quite frustrating to learn, but luckily, it won’t be necessary for your fundraising efforts. David recommends conducting fundraising efforts in both English and German. Given the ease of translating content today, even with a disclaimer like "translated automatically, please excuse any errors," running both languages in parallel can be an effective approach. Arnas from AddedVal.io adds: “Our platform and website are presented in German. However, once you're registered, all the processes, emails, and menus are in English to ensure that language skills don't become a barrier. We expect every business angel to be able to read and understand English texts, so that’s not an issue.”

The Power of Proximity: Why Berlin Matters in Early-Stage FinTech Funding

The very first investor in your FinTech is you – your time, effort, and emotional investment. Most likely, it's also your personal savings and the opportunity cost of leaving a steady job. In the next stage, you’ll hopefully get support from the “three F's”: Family, Friends, and Fools. This initial group is usually close to you, both emotionally and often geographically. However, as your fundraising journey progresses, physical proximity becomes less important. Angel investorsin the pre-seed and seed stages may still be locally connected, but later rounds with VCs and other funding vehicles are far less dependent on location. Ultimately, in the best-case scenario, exits and strategic acquisitions are rarely influenced by geography at all.

So, the stage where your startup’s location really matters are the early ones. And this is where Berlin shines. With its vibrant FinTech scene, startup entrepreneurs and investors actively accelerate the already mentioned flywheel effect, driving growth in the ecosystem.

Sophie from beatvest shares her view: “Our headquarters is currently in Munich, which is more for historical reasons. However, we’re increasingly shifting our focus towards Berlin and plan to relocate our company there in the future. Berlin plays an absolutely essential role for us. In our view, FinTech in Germany is centered almost entirely in Berlin, with some activity in Frankfurt, but the majority is here. You have fantastic initiatives like the newly established House of Finance and Tech, an incredible ecosystem, and numerous networking events. It’s so easy to connect with other founders. Honestly, I can’t think of a better city for FinTech in Germany.”

The House of Finance and Tech is indeed the latest flagship project within an already highly active, government-supported ecosystem designed to foster FinTech innovation and growth. The brand new House of Finance and Tech aka HoFT in Berlin is going to serve as a central hub for fostering innovation in the finance and tech sectors. It brings together startups, established companies, academia, and public institutions, offering knowledge-sharing opportunities, strategic partnerships, and access to resources aimed at driving growth in these industries.

The HoFT is an initiative launched by the Berlin Finance Initiative, Berlin Partner , and the IBB Unternehmensverwaltung. Earlier this year, both Berlin Finance Initiative and Berlin Partner successfully established FIBE, the FinTech festival that draws a wide-ranging audience from far beyond Berlin’s borders. While both organizations had already been running the de-hub-initiative on FinTech in Berlin, this proved to be a great starting point but clearly not sufficient to meet the growing needs of the FinTech ecosystem and their own ambitions. The same seems to be true for the public IBB, who actively supports FinTech Startups with funding through their programs IBB Ventures and VC Fonds.

Arnas, the banking veteran, says: “Berlin has really become an exciting hub for FinTech in recent years, with companies like N26 leading the way. As someone with ten years of banking experience, I find it a great development that FinTech has been recognized as a key industry here – not just in Frankfurt, where I think the relevance has even diminished a bit.”

Riding the Wave: Why Berlin Remains a FinTech Hub Despite Uncertainty

The history of FinTech funding in Berlin has been volatile, heavily influenced by macroeconomic factors. At the end of the day, investor capital has to come from somewhere. While angel investors often draw from their savings or personal exits, venture capital firms and other institutional investors are largely dependent on the capital markets for their own fundraising. Over the last two years, geopolitical tensions and the very real presence of war in Europe have significantly accelerated this volatility.

Today, while Germany remains Europe’s largest economy, it no longer serves as the continent's powerhouse. The economy has been teetering between recession and stagnation for some time now. Given these circumstances, it’s safe to assume that the future of FinTech funding in Berlin will continue to be marked by unpredictability.

Now that we’re aware of the unpredictability, is it still a problem? Yes, absolutely! Fintech startups are particularly capital-intensive, and after closing one funding round, founders often have to immediately shift their focus to securing the next.

If you're fortunate enough to have paying customers and generate some revenue, you might consider a strategic shift from growth mode to profitability mode, especially if funding conditions tighten. However, these pivots come at a cost – they can impact your team, alter terms with investors, and require time to fully implement. Balancing growth and financial sustainability becomes a delicate act in such volatile conditions.

However, Berlin’s flywheel effect in FinTech funding will continue to spin, even through uncertain market periods. Many new founders are likely to emerge, particularly employees from Berlin's established FinTech giants who venture out to start their own companies. Additionally, talent from outside Berlin will be drawn to the city, attracted by its dynamic FinTech ecosystem and the promising conditions it offers for launching new ventures.

As the FinTech industry matures, new ventures are increasingly focusing on specialized technical niches rather than mainstream solutions. This shift aligns perfectly with the rise of micro-VCs, where the total amount of capital available for investment is shrinking, yet funds are becoming more specialized. These domain-specific funds allow investors to develop deep expertise in targeted areas, fostering innovation in niche segments of the FinTech space. This trend supports a more refined, focused approach to funding, which is essential for driving success in specialized sectors that may require more tailored knowledge and strategic support.

Will Berlin’s most successful FinTech startups go public in their own city? Most likely not. Germany's largest stock exchange is based in Frankfurt, the country's financial capital. However, even Frankfurt might not be the go-to choice for IPOs. As FinTech startups mature, many look to the U.S. for more favorable capital market conditions, driven by factors like deeper liquidity and higher valuations. This trend of European tech firms heading to the U.S. for their public offerings raises concerns about whether local stock exchanges can compete. You can read more about this ongoing discussion between startups, stock exchanges, and the government in this German article at Handelblatt.

To close with Sophie Thurners wise words: “The great thing about Berlin is that no matter where else in the world you come from, you feel more welcome here than in any other German city. For example, you often speak only English in coffee shops, and that reflects on the FinTech scene as well. It's very diverse, and it creates a really cool environment.”

Text: Clas Beese, Freelance Journalist and Content Creator for FinTech, linkedin.com/in/clasbeese

Header image: © Adobe Stock - basketman23